Conventional Mortgages

A conventional mortgage or conventional loan is

a homebuyer's loan that is not offered or secured by a government entity.

What is a conventional mortgage?

A conventional mortgage is a home loan that isn’t insured by a government agency. Rather, it is a completely private instrument, its terms and parameters set by the bank, credit union or whatever financial institution is offering it. Virtually every type of mortgage lender offers conventional loans, and they are ideal for borrowers with a strong credit profile, stable income and minimal debt.

Conventional loans can come with a fixed or adjustable rate, and they can be conforming, meaning they fall within the loan limits set by the Federal Housing Finance Agency (FHFA), or non-conforming in that they exceed these limits. In 2024, the conforming loan limit is $766,550 in most areas, and $1,149,825 in pricier markets.

Who should consider a conventional loan?

Consumers have a number of types of home loans to choose from. Any borrower with solid credit, low debt and established income should consider a conventional loan. They are available to first-time and trade-up homebuyers, as well as those who are downsizing. Investors in single-family or multi-family dwellings might also consider conventional mortgages.

In contrast, borrowers with less-solid credit scores and ready cash might choose a mortgage backed by the Federal Housing Administration (FHA) or U.S. Department of Veterans Affairs (VA). These mortgages typically carry lower requirements around credit scores and down payments.

.

Comparing loan requirements

Here's how the requirements for different types of home loans — conventional and various government-insured loans — stack up against each other.

Conventional

FHA

VA/USDA

Jumbo

Non-QM

Pros and Cons of Conventional Loans.

Conventional loans are the most popular mortgage option, but even so, they’re not for everyone.

Some of the advantages and disadvantages:

PROS

* Can be used to finance a range of property types

* No loan limit

* Lower down payment acceptable

* Can cancel PMI when you reach equity threshold

* No upfront mortgage insurance

CONS

*Can be harder to qualify with a lower credit score

* Typically larger down payment requirements

* Can be more expensive with a lower credit score

* These loans may have higher interest rates

* PMI if less than 20 percent down

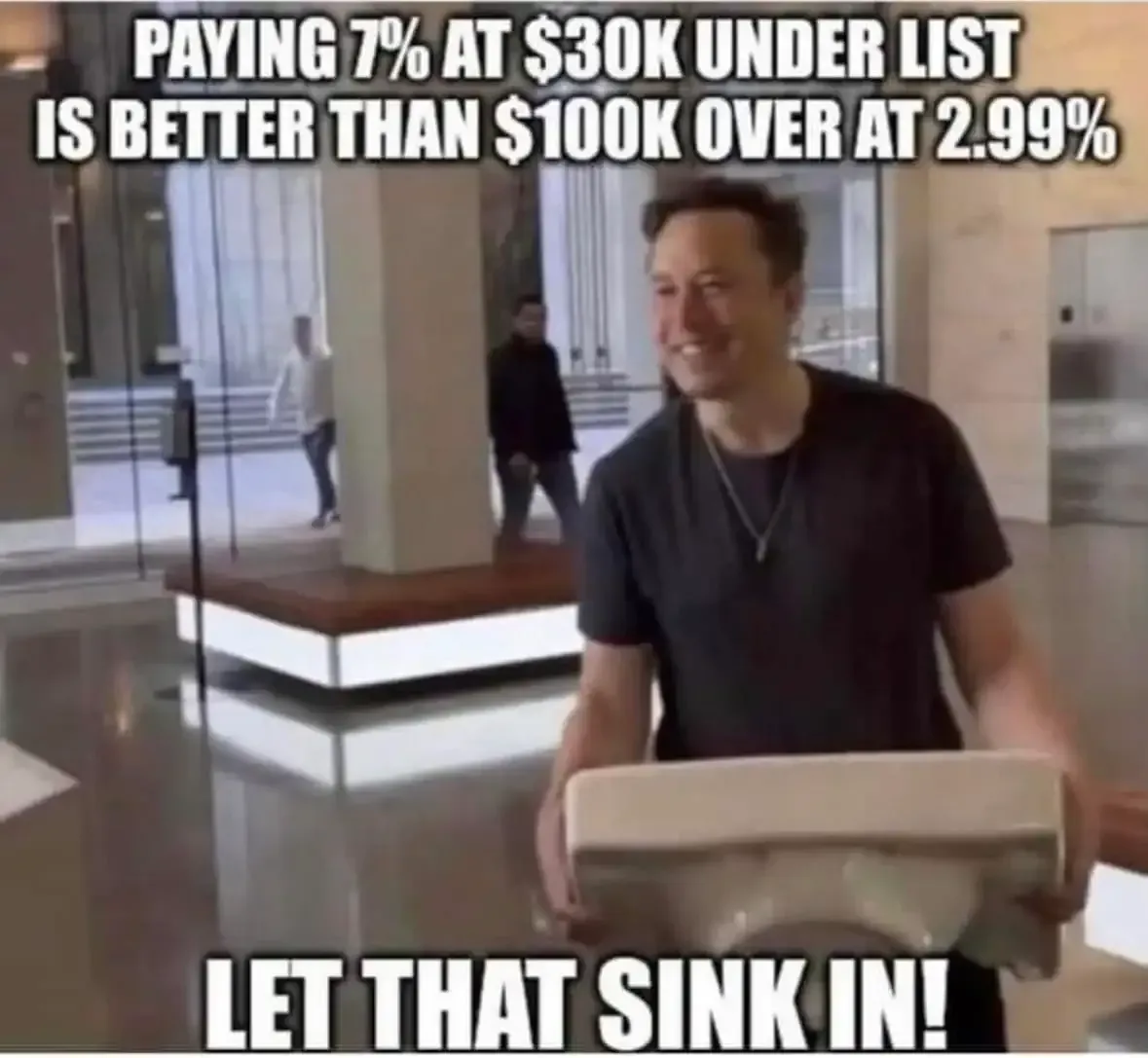

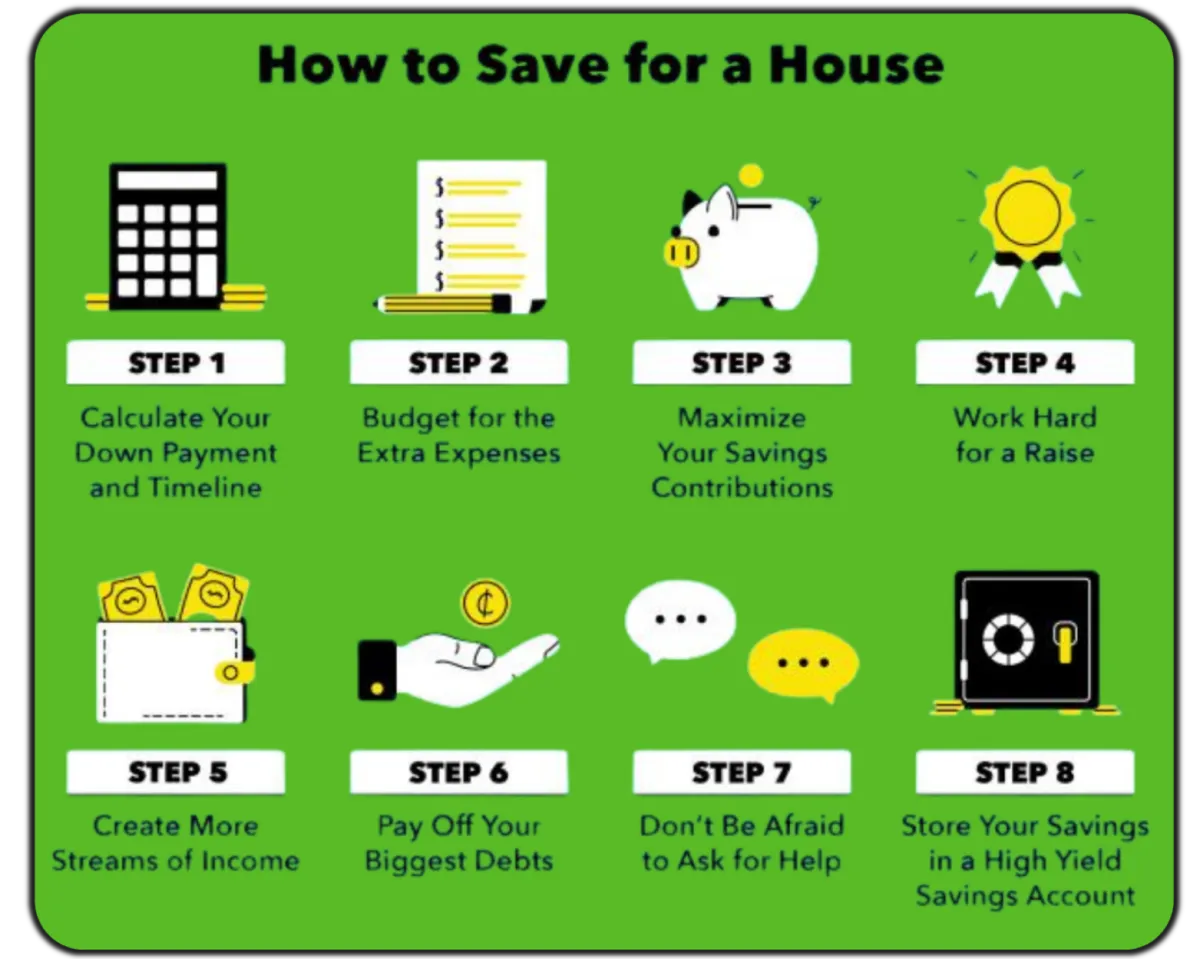

With everything going on in the world right now,

it is HARD to save for a down payment. But here is the deal...

You have to figure it out, because buying a home will change your life.

Here are some additional resources that can help...

And more are on the way.

Contact Us

623-696-8683

619 S Bluff Street Tower 2 Ste 1B

St George, UT 84770

Erik Miller is a Loan Originator (NMLS 263103) in AZ, CA, at an Equal Housing Lender at Patriot Home Mortgage LLC (NMLS 942696). 17505 N. 79th Ave. Glendale, AZ. AZ BK# 175386 Separately, Erik owns the BoringisBetter.com, which is education page used for informational purposes only. BoringisBetter.com is not a lender, does not issue loan qualifications, and does not extend credit of any kind. Disclaimer Link: https://linktr.ee/erikmillerhlt

Loan Officer – Erik Miller: NMLS #263103 | AZ LO-0927960 CA-DBO-263103 | Albert Luc NMLS #1474341 | AZ LO-948147Equal Housing Lender | Patriot Home Mortgage is a dba of Belem Servicing LLC. | Company NMLS #715386 | AZ NMLS #BK-976140 | Branch License #0122719

|

NMLS Consumer Access