FHA LOANS

What is an FHA mortgage?

FHA loans are government-backed mortgages for single-family and multifamily homes. They’re offered through FHA-approved lenders and insured through the Federal Housing Administration (FHA).

FHA loans are more accessible than conventional loans in that they have a lower credit score requirement: at least a 580 if you can put 3.5 percent down as a down payment, or 500 if you can put 10 percent down. Because of this, FHA loans are popular among first-time homebuyers, borrowers on tighter budgets and those who have lower credit scores.

FHA loan requirements

FHA loan limits: $498,257 for a single-family home; higher in costlier counties and for multifamily homes.

Minimum credit score: 580 with a 3.5% down payment, or 500 with a 10% down payment.

Maximum debt-to-income (DTI) ratio: Up to 50%

Mortgage insurance premiums (MIP): 1.75% of your loan principal upfront; monthly premiums thereafter based on amount you borrow, down payment and loan term and type.

Financial and work history: Proof of consistent employment and income

FHA mortgage insurance

FHA loans require borrowers who put down less than 20 percent to pay mortgage insurance premiums (MIP). Mortgage insurance costs add a meaningful amount to your monthly payment, so keep these costs in mind when you’re budgeting for a home.

There are two types of premiums: the upfront mortgage insurance premium (1.75 percent of the base loan amount) and an annual mortgage insurance premium (0.15 percent to 0.75 percent, depending on the loan term, loan amount and the loan-to-value (LTV) ratio). The annual premium is owed for the loan’s lifetime. In certain cases, the premiums can be removed.

Conventional

FHA

VA/USDA

Jumbo

Non-QM

FHA loan limits

Each year, the FHA updates its lending limits, or the maximum amount the agency will insure for a given area and type of property. These limits are influenced by mortgage market-makers Fannie Mae and Freddie Mac’s conforming loan limits.

For 2024, the national ceiling is $498,257 for a single-family home, and up to $1,149,825 in high-cost areas, but you can check your specific area by clicking here:

Pros and Cons for FHA Loans

PROS

* Low down payment requirement

* Friendly to first-time homebuyers (includes those who have not owned a home for at least three years)

* Financing for mobile homes and factory-built homes

* May accommodate people who own the land where the home will be located and those who live in a mobile home park

* Can lock in a low rate without a large down payment

CONS

* You'll be required to pay two types of mortgage insurance: an upfront mortgage insurance premium (MIP) and an annual premium

*The (MIP) can sometimes be more expensive than the conventional alternative.

*Once the (MIP) is on the loan, you cannot remove it without refinancing to non-FHA loan.

* Require that the house meet certain standards, which decreases buying options

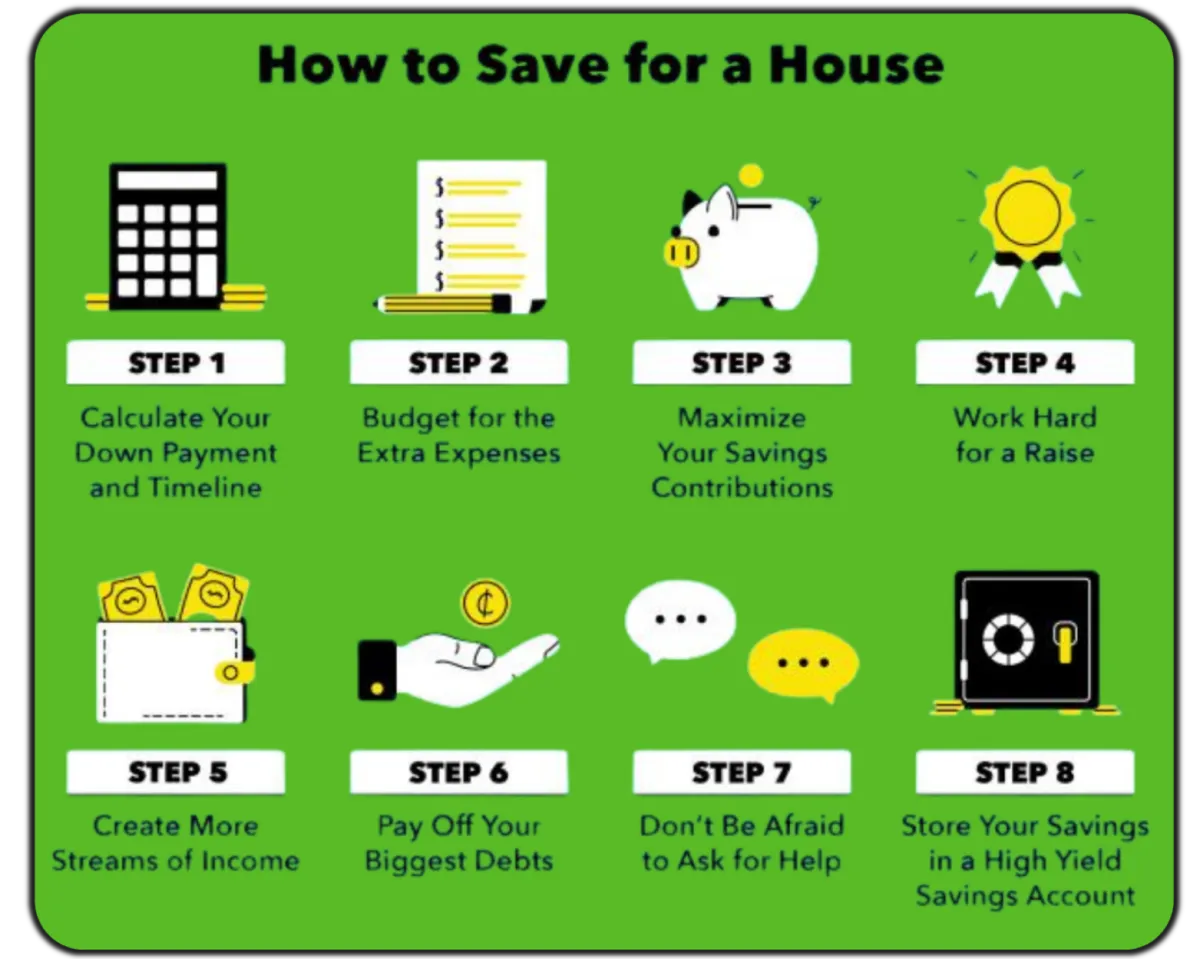

With everything going on in the world right now,

it is HARD to save for a down payment. But here is the deal...

You have to figure it out, because buying a home will change your life.

Then, once you in the application process...

Here are some additional resources that can FAQ Section help...

And more are on the way.

Frequently Asked Questions

How can we make positive difference for you today?

Should you get an FHA loan?

It really depends. An FHA loan can be a viable path to homeownership for many types of buyers, especially if you have a lower credit score. An FHA loan can also work well if you don’t have much down payment savings.

If you have a minimum 580 credit score, you’ll only need to put 3.5 percent down. All that said, If you'd like more information, click the bubble, call, set an appointment. Let us help you.

Are there different kinds of FHA Loans?

Absolutely. Here are the different loan types, and a brief outline the idea behind each loan type.

Basic home mortgage loan 203(b): A standard mortgage loan insured by HUD. Borrower must meet credit requirements and must purchase a one-to-four unit structure with a price below the area’s mortgage limit. Up to 96.5 percent financing available.

FHA adjustable-rate mortgages (ARMs): Unlike fixed-rate mortgages that have the same interest rate for the life of the loan, adjustable-rate mortgages will start out with a lower interest rate for a certain amount of time, and will then adjust to a higher rate once that period expires. The rate will then change on a regular basis, typically once a year. You might consider an ARM if you plan to sell the home before the rate adjusts to the higher level, or if you expect that your income will increase to compensate for higher payments. Otherwise, the risk of a significantly higher payment down the road is not to be taken lightly.

203(k) loan, aka rehabilitation mortgage: You can use this loan to finance up to $35,000 into your mortgage to repair, upgrade, or improve a single-family home.

Home equity conversion mortgage for seniors: You can use this reverse-mortgage program to withdraw a portion of your home’s equity to receive as income.

FHA streamline refinance: A refinance option that requires minimal borrower credit documentation and underwriting.

How Do I Qualify for a Mortgage?

Obviously a great question! Here is the quick answer: To qualify for a mortgage, an investor will typically look at several key factors: your credit score, credit history, your debt-to-income ratio (DTI), consistent employment or income history, and sufficient specific income and assets to repay the loan.

What Kind of Documentation do I need typically?

First things first, the specific documentation will often be determined by your specific situation. The best thing to do is to call or schedule an appointment to get it figured out for you.

That said, there are some basic guidelines for documentation needs, which are as follows: Credit Information, Proof of continued qualifying Income, asset statements, information regarding the property.

Okay, so it seems like a pretty small list - but each of the above items are actually several other items... so for more information you can check out the site (which could take hours).. or you can connect with us by clicking a couple of buttons. hahaha, whichever seems to make the most sense. 😉

Do FHA Loans Have lower interest Rate?

Well... usually, but (and this is going to sound odd) but the rate isn't everything. If the COSTS are way higher for one loan type or another, then the best rate is not always the best deal.... TRUELY, it depends on your exact situation. The most important thing to shopping a mortgage is... shameless plug (but it's true) ... it's the relationship you have with the lender. They should help lay out all the facts for you so that that you can make informed decisions based on what's important to you. That's the real answer.

That said, here is the ROBO-ANSWER: Rates for FHA loans are typically similar to those for conventional loans, although you might see lower interest rates advertised. For example, you might see a lower interest rate on an FHA loan compared to the interest rate on a conventional loan, but the FHA loan’s annual percentage rate, or APR, is higher. APR includes all of the fees associated with the loan.

What is the Process from Applying and Closing a Mortgage?

Seriously, you ask the BEST questions!!

There are 3 types of answers here. 1. The 4 part short answer. For that, keep reading. 2. The Exact, right, perfect for you answer. For that, click the button below and set up a pressure (or hassle) free appointment. 3. The long answer. For that, check out the rest of the website... which is also awesome, whatever works best for you!

Short Answer:

Part 1: Pre-Qualification: credit check, document submission, and pre-qualification issued.

Part 2: Home Search and Contracting: home search, home inspection, negotiation, executed purchase agreement.

Part 3: Loan Processing and Underwriting: processing, appraisal, underwriting, cycle of verification, approval

Part 4: Closing: closing arrangements, signing documents, compliance check, funds disbursement, title recording, keys.

How Much of a Down Payment is Required?

This entirely depends on the loan type. That said, since each situation is a little different... the best to do is....???? That's right, click the button below to set an appointment to find out for sure for your exact situation. hahaha, okay, commercial over.

There are (believe it or not) a bunch of different loan types. Each type of loan has different down down payment requirements.... AND each loan type has been created for each different situation.

The super basic loan types are: Conventional, FHA/VA/USDA, and "Jumbo" loans. Now, as I've shared, there are layers and layers to this stuff, but the bottom line is that your situation will most likely determine what loan type will work best... so don't let it stress you.

As always, I hope you will click around and check out the site... there are TONS AND TONS of different pages with videos, links, downloads... it may not be everything, but it's lot and it will be helpful to you.

What are Closing Costs and How Much Should I Expect to Pay?

The specifics of the closing costs will somewhat be determined by the lender you choose... that's why you should pick Patriot Home Mortgage, because they're awesome. Am I biased? Yes, but does that doesn't mean I'm incorrect??? Nope.

The total closing costs typically range from 2% to 5% of the loan amount. It's important to review the Loan Estimate and Closing Disclosure provided by your lender (regardless of whom you choose) for specific cost details. These documents will give you a detailed breakdown of all the charges you'll be responsible for at closing.

Want more detailed information? Click Here.

Why Do I Want a Boring Mortgage?

The reason you want a boring mortgage is because you don't want there to be any last minute changes, or unexpected things pop up at the last minute. For example. Let's say you are expecting to move on Friday because you house is closing. Yeah!!!

What happens if you get a call on Thursday night and it's like "Oh, hey.. yeah, we don't know if you can qualify. We'll let you know." That's pretty exciting, isn't it.

Looking for a house and picking the right house, that's exciting. Buying a house shouldn't be. That's our philosophy.

Contact Us

623-696-8683

619 S Bluff Street Tower 2 Ste 1B

St George, UT 84770

Erik Miller is a Loan Originator (NMLS 263103) in AZ, CA, at an Equal Housing Lender at Patriot Home Mortgage LLC (NMLS 942696). 17505 N. 79th Ave. Glendale, AZ. AZ BK# 175386 Separately, Erik owns the BoringisBetter.com, which is education page used for informational purposes only. BoringisBetter.com is not a lender, does not issue loan qualifications, and does not extend credit of any kind. Disclaimer Link: https://linktr.ee/erikmillerhlt

Loan Officer – Erik Miller: NMLS #263103 | AZ LO-0927960 CA-DBO-263103 | Albert Luc NMLS #1474341 | AZ LO-948147Equal Housing Lender | Patriot Home Mortgage is a dba of Belem Servicing LLC. | Company NMLS #715386 | AZ NMLS #BK-976140 | Branch License #0122719

|

NMLS Consumer Access